BBA in Fintech

BBA in Fintech Course Overview

BBA in Fintech is a new-age undergraduate program that combines knowledge of business administration principles with cutting-edge financial technologies. This interdisciplinary course equips students with the skills crucial to dealing with modern financial markets and digital finance. It is designed to make students job-ready for the fast-evolving financial technology industry.

BBA in Fintech syllabus includes digital banking, blockchain technology, cryptocurrencies, digital payments, and cybersecurity, alongside traditional business courses in management, economics, and marketing. The curriculum is structured to help students develop critical thinking, problem-solving, and technical skills. They also learn how to create and implement technological solutions in finance, which makes them suitable candidates to work in banks, insurance companies, regulatory agencies, and fintech startups.

BBA in Fintech is a job-ready assured program that makes students competent enough to work as financial analysts, fintech product managers, blockchain developers, and digital currency advisors. The top colleges in India offering BBA Fintech include Doon Business School, Symbiosis Skills and Professional University, Anil Surendra Modi School of Commerce, Chandigarh University, MIT ADT University, and more. Let’s explore the details of the BBA in Fintech course below.

Table of Contents

- BBA in Fintech Course Overview

- BBA in Fintech Course Highlights

- Why Choose a BBA in Fintech Degree?

- What is an Online BBA in Fintech Degree?

- Types of BBA in Fintech Programs

- BBA in Fintech Eligibility Criteria

- BBA in Fintech Admission Process in India

- BBA in Fintech Syllabus

- Top Colleges Offering Specialised Job-Ready BBA in Fintech Courses

- Career Options After BBA in Fintech

- Courses After BBA in Fintech Degree

- FAQs about BBA in Fintech

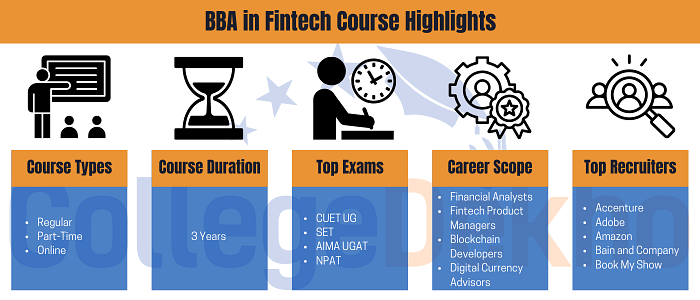

BBA in Fintech Course Highlights

Check out the highlights of the BBA in Fintech course provided in the table below:

| Particulars | Details |

|---|---|

| Name of the Course | BBA in Fintech |

| Course Level | Undergraduate |

| Course Duration | 3 Years |

| Eligibility Criteria | Passed class 12th with 50% marks from a recognized board |

| Admission Process |

|

| Popular Entrance Exams | CUET UG, SET, AIMA UGAT, etc. |

| Top BBA in Fintech Colleges | Doon Business School, Symbiosis Skills and Professional University, Anil Surendra Modi School of Commerce, Chandigarh University, MIT ADT University. |

| Course Fees | INR 3- 8 Lakhs |

| Average Starting Salary | INR 20,000 Per Month |

| Top Job Profiles | Financial analysts, Fintech Product Managers, Blockchain Developers, and Digital Currency Advisors. |

| Top Recruiters | Accenture, Adobe, Amazon, Bain and Company. Book My Show |

Why Choose a BBA in Fintech Degree?

Choosing a BBA in Fintech offers numerous benefits for students interested in the intersection of finance and technology. Here’s why you should consider this degree:

- Diverse Career Opportunities: A BBA in Fintech prepares students for various roles and opens doors to careers in banks, startups, regulatory bodies, and financial institutions.

- High Earning Potential: Fintech professionals earn high salaries due to their specialized expertise and the demand for their skills.

- Industry Growth: The fintech industry is rapidly growing, creating a high demand for professionals skilled in both finance and technology.

- Skill Development: Students learn about data analytics, programming, cybersecurity, and financial management, equipping them with versatile skills.

- Innovation and Disruption: Enrolling in this field can help you be part of cutting-edge developments in blockchain, cryptocurrency, robo-advisors, and peer-to-peer lending platforms.

What is an Online BBA in Fintech Degree?

An online BBA in Fintech degree provides flexibility and accessibility to students with other commitments or who prefer remote learning. It allows students to access coursework and lectures conveniently, making it easier to balance studies with work, family, or other responsibilities. Many online programs use interactive platforms that include video lectures, discussion forums, live Q&A sessions, and group projects to create engagement and collaboration among students and instructors.

Types of BBA in Fintech Programs

The BBA in Fintech programs are offered in different modes of study to accommodate the needs of every student. Here are the different types of courses available:

| Type of Course | Details | Duration |

|---|---|---|

| Regular | A regular BBA in Fintech involves attending classes on the university or college campus, participating in face-to-face interactions with faculty and peers, and engaging in various on-campus activities. | 3 Years |

| Part-Time | A part-time course is designed for students who wish to balance their studies with other commitments. It offers flexibility, allowing students to complete their degree at a slower pace compared to full-time programs. | 3-4 Years |

| Online | It is delivered online, allowing students to study from anywhere and at their own pace. This flexibility is ideal for those balancing education with other responsibilities. | 3-4 Years |

BBA in Fintech Eligibility Criteria

Students must fulfill the following requirements to be eligible for a BBA in Fintech course.

- Education Qualification: Passed class 12th examinations from any stream and a recognized board.

- Minimum Marks: Achieved a minimum aggregate of 50% marks in 12th exams.

- Age Limit: Candidates should be aged between 17 to 24 years.

Skills Required for BBA in Fintech

- Business Skills: Financial Literacy, Management Skills, Marketing, Business Law and Ethics

- Technical and Analytical Skills: Data Analytics, Programming and Software Development, Blockchain and Cryptocurrencies, Cybersecurity

- Fintech-Specific Skills: Digital Payments and Platforms, Regulatory Knowledge, Artificial Intelligence and Machine Learning

- Soft Skills: Communication, Problem-Solving and Critical Thinking, Adaptability and Continuous Learning, Collaboration and Teamwork

BBA in Fintech Admission Process in India

Admission to BBA in Fintech courses is offered in two ways: merit-based and entrance exam-based. These two have been explained in detail below.

Entrance Exam-Based Admission

Many institutes offer admission to BBA in Fintech courses based on the scores in entrance exams like CUET UG, SET, NPAT, AIMA UGAT, and more. Students seeking admission through this route have to appear for these entrance exams, meet the cutoff of the desired college, and then participate in the counselling. It must be noted that the requirements for entrance exams vary according to the college to which one is seeking admission, so candidates are advised to check all the requirements before applying.

Direct Admission Based on Merit

Direct BBA in Fintech admission process is an excellent option for students who don’t want to go through the hassle of preparing and appearing for entrance exams. Many colleges in India offer direct admission based only on academic records. Students seeking direct admission have to fill out the application for the desired college and may appear for a personal interview.

BBA in Fintech Syllabus

The BBA in Fintech syllabus is divided into three years, each with two semesters. Here is the list of subjects taught in each semester of the BBA Fintech course.

| Semester I | Semester II | Semester III |

|---|---|---|

|

|

|

| Semester IV | Semester V | Semester VI |

|

|

|

Top Colleges Offering Specialised Job-Ready BBA in Fintech Courses

Here’s a list of the top colleges offering BBA in Fintech courses along with their ranking and course fees.

| Name of the College | Total Course Fees | Ranking |

|---|---|---|

| Doon Business School, Dehradun | INR 5.82 Lakhs | No.1 B-School in Uttarakhand - The Week 2023 |

| Symbiosis Skills and Professional University, Mumbai | INR 8.13 Lakhs | 8th Best Among Outlook Ranked Colleges In Pune in 2023 |

| Anil Surendra Modi School of Commerce, Mumbai | INR 14 Lakhs | 2nd Best Among Times Ranked Colleges in Maharashtra In 2023 |

| Chandigarh University, Chandigarh | INR 6.44 Lakhs |

|

| MIT ADT University, Pune | INR 7.83 Lakhs | Overall NIRF Ranking - 51 out of 312 colleges in India in 2023 |

| Chitkara University, Rajpura | INR 4.2 Lakhs | #64 in the 'Management Institutes' category by the NIRF 2023 |

| Institute of Logistics and Aviation Management, New Delhi | INR 3.90 Lakhs | NA |

| Christ University, Bangalore | INR 6.9 Lakhs | Best Among Outlook Ranked Colleges in Bangalore in 2023 |

| Chaitanya Deemed to be University, Hyderabad | INR 2.7 Lakhs | NA |

| Cheran Arts & Science College, Kangeyam | INR 1.35 Lakhs | NA |

| DEV Bhoomi Uttarakhand University, Dehradun | INR 2.4 Lakhs | 183 out of 193 colleges in India in 2023 by The Week |

| Jaipur National University, Jaipur | INR 4.75 Lakhs | 5th Best Among India Today Ranked Colleges In Rajasthan In 2023 |

| Rai University, Ahmedabad | INR 2.1 Lakhs | IIRF - Overall #126 out of 171 colleges in India 2023 |

| Rai Technology University, Bangalore | INR 3 Lakhs | NA |

| SMS College of Arts & Science, Coimbatore | INR 3.6 Lakhs | NA |

Career Options After BBA in Fintech

BBA in Fintech is an innovative program that makes students job-ready right after graduation. With a solid foundation in business administration principles and financial technology concepts, students become adept at handling various responsibilities that come with jobs in the field. Let’s explore the top job profiles, salaries, and top recruiters for BBA in Fintech graduates.

Top BBA in Fintech Job Profiles

| Job Profile | Description |

|---|---|

| Fintech Analyst | Analyze market trends, new technologies, and financial services to provide insights that help companies make informed decisions. |

| Blockchain Developer | Work on developing decentralized applications, smart contracts, and protocols that can transform financial services. |

| Cybersecurity Analyst | Work to safeguard a company's information systems by monitoring, detecting, investigating, analyzing, and responding to security incidents. |

| Data Scientist | Analyze complex financial datasets using statistical models, machine learning algorithms, and big data processing techniques. |

| Digital Marketing Manager | Create and lead online marketing campaigns to promote fintech products and services. |

| Product Manager | Work closely with engineers, designers, and business teams to build innovative, user-friendly solutions. |

| Financial Planner/Adviser | Offer advice on managing finances, making investment choices, and planning for future financial needs. |

| Compliance Officer | Ensure that companies adhere to all laws and regulations, monitor changes in legislation, and develop policies to prevent non-compliance. |

| Mobile Application Developer | Focus on developing secure, user-friendly apps that facilitate financial transactions and services. |

BBA in Fintech Salary

| Job Level | Average Salary |

|---|---|

| Entry Level | INR 2-3 LPA |

| Mid Level | INR 7-9 LPA |

| Experienced Level | INR 12-15 LPA |

Top BBA Fintech Recruiters

| Accenture | Adobe | Amazon |

|---|---|---|

| Bain and Company | Book My Show | Capgemini |

| Cleartrip | Cognizant | |

| Flipkart | Happiest Minds | |

| IBM | Infosys | KPMG |

| Make My Trip | Microsoft | Mind Tree |

| Oracle | Snapdeal | TCS |

Courses After BBA in Fintech Degree

After getting a BBA in Fintech degree, students can opt for various courses to enhance their knowledge and skills in the field. Some of the popular options include:

- MBA in Finance or Fintech: An MBA in Finance can help deepen your understanding of business and finance. Some programs offer specializations in Fintech, covering advanced topics in financial technology.

- MSc in Financial Technology: This program focuses on the technological aspects of finance, including subjects like blockchain technology, digital currencies, cybersecurity, and data analytics.

- PGD in Financial Technology: This can be a shorter alternative to a master's degree, offering specialized knowledge in Fintech and its applications in the financial services industry.

- Certified Financial Analyst (CFA) Program: If you're interested in investment management, the CFA charter is a highly recognized qualification that covers topics such as ethical and professional standards, quantitative methods, and financial reporting.

- Certified Information Systems Auditor (CISA): For those inclined towards the security aspect of Fintech, CISA certification can provide the necessary knowledge and skills to audit, control, and secure information systems.

- Data Analytics or Big Data Certification: Since Fintech heavily relies on data, a certification in data analytics or big data can be extremely beneficial. These courses teach you how to interpret complex datasets to make informed decisions.

FAQs about BBA in Fintech

What is the BBA in Fintech course fees?

BBA in Fintech course fees vary by college. For instance, the total course fee for Doon Business School is INR 5.82 lakhs, while for Symbiosis Skills and Professional University, it is 8.15 lakhs. The fee at Anil Surendra Modi School of Commerce is INR 14 lakhs and Chandigarh University is INR 6.44 Lakhs.

What is the average salary for BBA Fintech graduates?

The average salary for BBA in Fintech graduates at entry-level positions is INR 2-3 lakhs per annum. Mid-level professionals with experience of more than 5 years can expect to earn between INR 7-9 lakhs per annum. Experienced professionals who have been in the industry for more than 10 years can get a salary between INR 12-15 LPA.

What jobs can I get after completing BBA in Fintech?

Graduates can get jobs as Fintech Analysts, Blockchain Developers, Cybersecurity Analysts, Data Scientists, Digital Marketing Managers, Product Managers, Financial Planners/Advisers, Compliance Officers, Mobile Application Developers, and more after completing a BBA in Fintech.

What subjects will I study in BBA in Fintech?

The subjects that students will study in BBA in Fintech include Principles of Economics, Financial Accounting, Business Mathematics, Corporate Finance, Database Management Systems, Investment Analysis and Portfolio Management, Risk Management in Financial Services, Financial Data Analytics, Artificial Intelligence in Finance, and Entrepreneurship and Innovation in Fintech.

Can I pursue a BBA Fintech online?

Yes, students can pursue BBA Fintech online. It is a great option for individuals who want to earn a degree but don't have time to attend on-campus classes due to other commitments. The lectures are delivered online which students can access at their convenience.

Which colleges offer BBA in Fintech?

The colleges that offer BBA in FIntech include Doon Business School, Symbiosis Skills and Professional University, Anil Surendra Modi School of Commerce, Chandigarh University, MIT ADT University, Chitkara University, Chaitanya Deemed to be University, DEV Bhoomi Uttarakhand University, Jaipur National University, and more.

Can I get direct BBA in Fintech admission?

Yes, students can get direct BBA in Fintech admission on the basis of their academic record. Those who have completed class 12th with at least 50% marks can apply for admission by filling out the application form for the desired college.

How can I get admission to BBA Fintech courses?

To get admission to BBA Fintech courses, students can appear for the entrance exams or apply directly based on merit only. Colleges that accept admission through entrance exams require students to meet the cutoff and participate in counselling. Direct admission is offered on the basis of a student’s past academic performance only.

Who is eligible for BBA in Fintech?

Students who have completed class 12th with at least 50% marks from a recognized board are eligible for BBA in Fintech. Those who are awaiting the result can also apply for the course, but admission will be subject to the final aggregate achieved by the candidate.

What is a BBA in Fintech course?

A BBA in Fintech is an undergraduate program that merges finance, technology, and business studies. It equips students with knowledge about digital banking, blockchain, cryptocurrencies, digital finance, and regulatory technologies, preparing them for the evolving financial services sector.

Popular Courses

- Courses

- BBA in Fintech