BSCC Application Process for Diploma Students: The Bihar Student Credit Card (BSCC) scheme is a landmark initiative by the Government of Bihar to enable students to access financial aid for higher education in diploma courses. This initiative aims to reduce the economic strain on students and allow them to pursue their studies without the distress of paying for tuition, books and other academic related fees. Education becomes more accessible and affordable through loans of up to INR 4 lakh at an interest rate of 1-4% under the BSCC scheme. The Bihar Student Credit Card loan application process is conducted in online mode. To apply for BSCC loan for diploma courses, you only need to register yourself on the Bihar Student Credit Card portal , fill out the online application form, upload the necessary documents, select the desired courses and submit the form.

In this article, we have explained the step-by-step BSCC application for diploma students, defined the Bihar student credit card diploma eligibility, and highlighted the best diploma courses under BSCC scheme.

Also Check -

How to Register on the BSCC Portal

How Diploma Students Can Apply for BSCC Loan

This BSCC scheme is available for those students who are looking to pursue higher education in diploma courses. Given below are the instructions on how diploma students can apply for BSCC loan.

1. Visit the Official Website

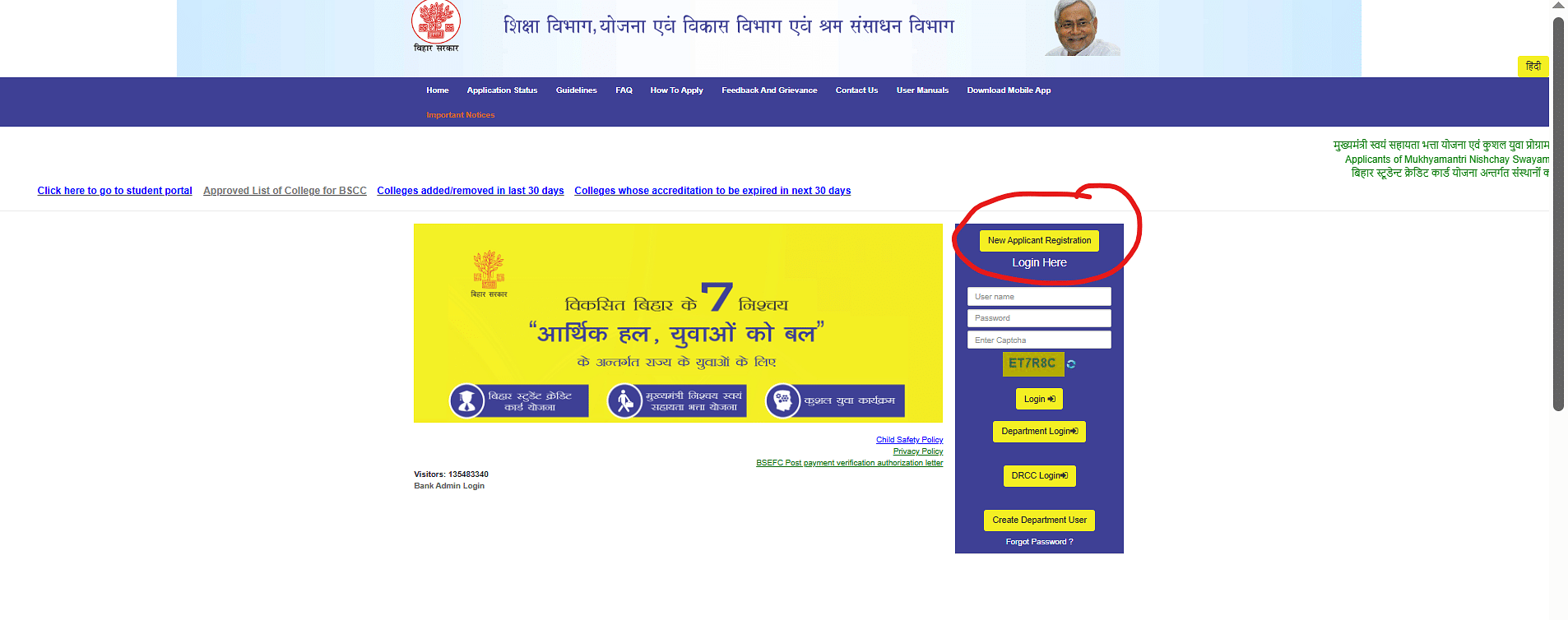

The first step is to visit the BSCC official site (7nishchay-yuvaupmission.bihar.gov.in) where you know about the scheme in a detailed way i.e.; criteria, loan limits and application forms.

2. Register as a New Applicant

From this site as a diploma student, you will have to click on 'New Applicant Registration' on the homepage to sign up for registration.

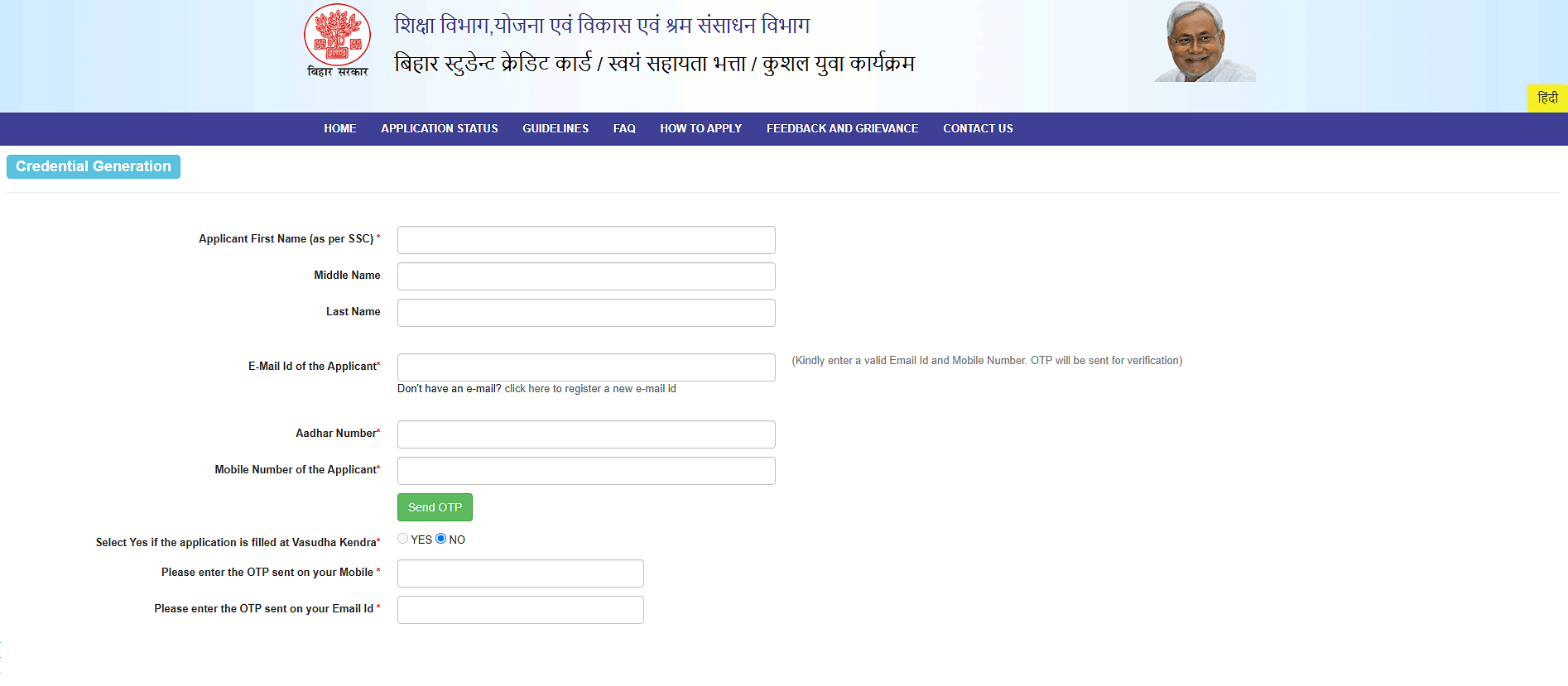

3. Create an Account

Next, you will be redireted to a new page where you must share some information such as your full name, email ID and mobile number. Once you go through this process you can access your application form with a login ID and password.

4. Complete the Application Form

Once you are logged in you will have to complete the application form online. You will have to fill out your details such as your full name, date of birth, contact information and education details as well as what course you wish to pursue. You must ensure that all the information is accurate to avoid mistakes during the approval process.

5. Upload Required Documents

To apply for a Bihar Student Credit Card you have to provide the following documents:

Document | Details/Requirement |

|---|---|

Aadhaar Card | You must have a valid Aadhaar card to verify identity. |

Pan Card | You must submit a valid PAN Card copy to verify identity. |

Income Certificate | This document proves your family’s annual income. It can be collected from your local tehsil or online government portal. |

10th/12th Marksheet | The 10th/ 12th standard final exam marks card is the most important to qualify for this scheme. |

Proof of Admission | A letter from your educational institute stating that you are admitted to the course you mentioned is required. |

Bank Account Details | Your bank account details is also required for loan disbursement. |

Photograph | The latest passport-size photograph of you must be ready. |

Residential Proof | Other supporting documents such as a voter ID, a ration card, an electricity bill to prove your residential address etc. are needed. |

Other Documents | Admission Proof, Fee Structure |

Also Check - Documents Required for Bihar Student Credit Card

6. Submit the Application

After uploading all of the required documents you must submit the form. You will then be given confirmation your application has been submitted and application is processed.

7. Verification and Approval

The government will examine the application and documents. After applying you must visit the District Registration and Counseling Center (DRCC) within 60 days with the necessary documents for verification. After verification you will be notified whether your application has been approved. The BSCC loan amount will be applied to your account after the loan is approved.

Step-by-Step BSCC Application for Diploma Students

How diploma students can apply for BSCC loan includes a series of simple steps from online registration to the final submission. You can follow the step-by-step BSCC application for diploma students below:

Step | Action | Details |

|---|---|---|

1 | Registration | Register on the official BSCC website using personal details. |

2 | Document Upload | Upload necessary documents such as Aadhar card, academic certificates and income proof. |

3 | Fill Application | Complete the application form with accurate details about the diploma course and institution. |

4 | Submission | Submit the completed form and uploaded documents. |

5 | Loan Sanction | Wait for loan approval, which will be reviewed by the concerned authorities. |

6 | Loan Disbursement | Once approved the loan is directly transferred to the educational institution. |

Once you complete your submission process, the BSCC authority will look at your application and crosscheck your details. Once they approve your application, the loan will be disbursed. The amount is credited directly to the college account to pay the fees. However, if you are studying a diploma course that needs additional expenses (like books, equipment etc.) then the funds can be transferred to your personal account. Those of you who have taken BSCC loan for diploma courses must repay the loan. The scheme offers repayment tenures of up to 5-7 years at a low interest rate. This loan repayment should be made during this time but there is also a provision for an extended repayment if you are studying further.

Also Check -

Loan Amount and Repayment Terms for BSCC

Bihar Student Credit Card Diploma Eligibility

To be eligible for BSCC loan for diploma courses, you must meet the Bihar student credit card diploma eligibility established by the State Government. These criteria ensure that the scheme will benefit the correct students. The following are the principal eligibility requirements for diploma students:

1. Domicile: You must be a permanent resident of Bihar. If you do not have a domicile certificate as proof, check how to get your Domicile Certifiate for BSCC before applying.

2. Educational Qualification: You must have completed your matriculation (Class 10) and enrolled in an accredited diploma program. The Bihar Government should recognize the college where you enrolled for the diploma course.

3. Age Limit: You must be under the age of 25 at the time of applying to the BSCC scheme.

4. Income Limit: Your annual family income should not exceed INR 6 lakhs for all categories. You should read about income criteria for BSCC loan approval beforehand.

5. Enrollment in a Recognized Institution: You must be enrolled in a recognized institution offering diploma programs. These diploma courses must be recognized by the State or Central government to be eligible for BSCC loan assistance.

Best Diploma Courses under BSCC Scheme

The Bihar Student Credit Card course list is released on the MNSSBY portal. The most popular and valuable diploma courses you can apply under the BSCC Scheme are as follows:

Diploma in Engineering | Diploma in Food, Nutrition/ Dietetics |

|---|---|

Diploma in Food & Beverage Services | Diploma in Food Processing/Food Production |

Diploma in Hotel Management | Diploma in Aeronautical, Pilot Training, Shipping |

The Bihar Student Credit Card Scheme is an effective option for diploma students in Bihar, who need financial assistance to pursue higher education. By knowing how diploma students can apply for BSCC you can take advantage of the loan to help with the cost of living and academic expenses.

More Useful Links

Are you feeling lost and unsure about what career path to take after completing 12th standard?

Say goodbye to confusion and hello to a bright future!

FAQs

The BSCC loan eases the financial burden on the students by helping them pay tuition fees, books and other study-related expenses. The loan helps students focus on their studies without worrying about financial concerns.

The required documents are:

- Aadhaar Card

- PAN Card

- Income Certificate

- 10th/12th Marksheet

- Proof of Admission

- Bank Account Details

- Passport-size Photograph

- Residential Documents (e.g., identification cards for voters or ration cards)

The BSCC loan approval process usually takes a few weeks. Applicants will be notified of loan approval after submitting the application and verifying documents. The loan is then debited to the institution's account.

Applicants must

- Have a residence in Bihar

- Have completed class 10 and enrolling in a recognized diploma program

- Must be younger than 25 years of age.

- Have a household income that is not over Rs6 lakh per year.

Once the application is submitted, the application and documents will be verified with the help of authorities. Students are required to visit the District Registration and Counseling Center (DRCC) to confirm the validity of documents. Once verified the loan process begins and the loan will be paid when the loan application is approved.

Once the loan has been approved, the funds are transferred directly to the educational institution to pay tuition fees. Funds for other expenses such as books and equipment may be transferred to a student's account.

Students can get a loan of up to Rs 4 lakh through the BSCC scheme. The loan can pay tuition, examination fees, books and other costs that make university education more accessible and affordable.

The loan repayment period under BSCC is 5-7 years. After completing the diploma course students can start repaying. There are also repayment options available that can make it easier for the student to pay off once they get into a line of work such as a more extended repayment period if the student enters further study.

Was this article helpful?

Similar Articles

Police Ranks in India: Check Rank List PDF, Police Posts with Badges, Stars & Salary

BSCC Application Process for Engineering Students

How to Pay Back BSCC Loan (Bank Details & EMI)

Documents Required for WB Student Credit Card

How to Apply for West Bengal Student Credit Card?

Top Institutes with 100% Job Placements in 2024-25: Highest Package, Key Recruiters