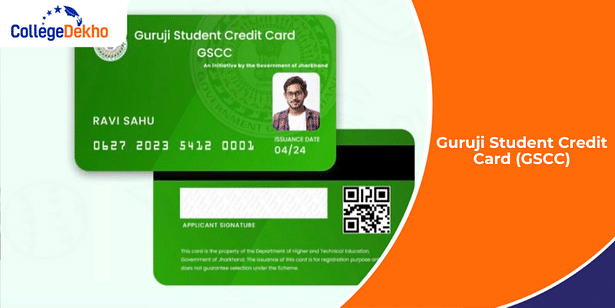

To begin with, the GSCC full form is Guruji Student Credit Card , which is also known as the Jharkhand Student Credit Card scheme. This scheme was started by the Department of Higher and Technical Education, Government of Jharkhand, to provide financial support in the form of loans to students pursuing higher education at a subsidised interest rate and other benefits. The Guruji credit card scheme offers education loans up to INR 15 lakhs at a subsidised simple interest rate of 4% to eligible students. Plus, it offers additional benefits to female students. In order to avail the benefits of the Guruji Student Credit Card Yojana , you must visit the official website of the GSCC scheme @gscc.jharkhand.gov.in.

Also Read:

Guruji Student Credit Card Scheme Details

Under the Guruji government student credit card scheme, if you have completed Class 10 and Class 12 education from a recognized school in the state of Jharkhand and have secured admission into any of the institutes listed under the scheme, you will be offered educational loans up to INR 15,00,000 at an annual nominal interest rate of 4%, with no collateral. The objective of this scheme is to promote higher education among families who are financially challenged and thereby are unable to afford education for their children.

The financial aid taken through the Guruji Student Credit Card Yojna can be used to cover tuition, hostel/mess, food, lab, library, and examination fees, caution deposit, building fund, refundable deposit, material purchases such as books, computer and equipment, living, food, medical, conference, seminars, competitions, and travel expenses. Also, students can apply for the Jharkhand Student Credit Card for various types of courses like B.A/B.Sc and professional/ technical courses like engineering ( BTech course )/ medical (MBBS)/ management/ law.

Guruji Student Credit Card Scheme Eligibility

In order to avail the Guruji Credit Card Scheme, you must meet all the eligibility criteria set by the Department of Higher and Technical Education, Government of Jharkhand. Take a look at the GSCC eligibility requirements below:

- You must be an Indian national domiciled in Jharkhand to avail this scheme.

- You must be pursuing a diploma, undergraduate, postgraduate, Ph.D., or any higher-education course from a recognized school/institution or university within or outside Jharkhand.

- You must have completed Class 10th to pursue a diploma, and Class 10th and 12th from a recognized school in Jharkhand to pursue undergraduate or higher courses.

-

You must have secured admission in institutions which have a rank of 200 or higher in the overall list, or have a rank of 100 or higher in their respective individual category of NIRF Rankings, or have been accredited grade of either “A" or above by NAAC at the time of application. These institutions must be within and/or outside the state of Jharkhand (within India) and may include the following:

- Indian Institutes of Technology (IITs)

- Indian Institutes of Management (IIM)

- Indian Institutes of Engineering Science and Technology (IIEST)

- Indian Statistical Institute (ISI)

- National Law Universities (NLU)

- All India Institute of Medical Sciences (AIIMS)

- National Institutes of Technology (NIT)

- Xavier School of Management (XLRI)

- Indian Institute of Science (IISc)

- Birla Institute of Technology and Science (BITS)

- Schools of Planning and Architecture (SPA)

- National Institute of Design (NID)

- Indian Institute of Foreign Trade (IIFT)

- ICFAI Business School

- You must not be more than 40 years of age at the time of application.

- You must not be a prior beneficiary of the scheme.

- You must not have any prior records of having availed education loan from any State Co-operative Banks, Central Co-operative Banks, District Central Co-operative Banks, or any Public or Private sector Banks for your higher-education course.

Also Read:

Guruji Student Credit Card Scheme Benefits

The Guruji Student Credit Card Yojana not only offers education loans to students at a subsidized rate, but also provides several other benefits that ease the financial burden of a student and their family. Check out some of the primary benefits under the Guruji Student Credit Card Scheme below:

- You will receive a loan up to the amount of INR 15,00,000 at a subsidised interest rate of 4% per annum without any collateral security.

- If selected, you will also be entitled to a one-year moratorium or repayment holiday, whichever comes first, upon course completion or securing employment.

- Before the designated payback period, your legal guardian may repay the loan balance at any time. The Multilateral Convention to Implement Tax Treaty Related Measures to Prevent Base Erosion and Profit Shifting (MLI) will not impose any penalties or processing fees for early repayment.

- You have the option of using the moratorium or repayment holiday specified in Section 9 of the Scheme, or you can start repayments while you are still enrolled in classes.

- You will receive a 1% reduction in interest rates for the duration of your loans if you decide to pay off the interest while you are still enrolled in classes. This implies that you will pay less interest overall, and the MLI will be responsible for covering the concession's financial burden.

- You will only pay a 4% annual simple interest rate on the loan because the Directorate of Higher & Technical Education (DHTE) will pay a portion of the interest.

- The interest subvention amount for the disbursed loan is automatically determined by the GSCC portal, which then distributes the money from the corpus fund to the loan account.

- The interest subvention amount on the disbursed loan to MLI is automatically paid by the GSCC portal in accordance with the timetable that DHTE and MLI have agreed upon.

Also Read:

Guruji Student Credit Card Scheme Application Process

If you are interested in applying for the Guruji Student Credit Card Scheme, you must know the application process and the steps you need to take to submit your application. The GSCC application process has been explained below:

- First, you must visit the official website of GSCC online @gscc.jharkhand.gov.in.

- Next, you must click on the “Registration” button in the top right corner and enter the necessary details.

- Subsequently, you will be asked to verify your contact details through One Time Password. After verification, you will get a registration number via SMS.

- After successful registration, you can use your User ID, Password, and captcha to login to the portal and continue your application process.

- After logging in, you must fill out the application form with basic details like your personal information, educational information, residential information, etc.

- You must also upload your recent photograph and signature.

- Once all the details are submitted, you can click on “Submit” and you will get the application ID.

After you have submitted your application, it will go through various stages of verification and processing. Your application will be reviewed by the Student Member Lending Institution, and if selected, the same will be approved after which the MLI will upload the loan details, including amount, duration, and repayment period, along with the sanction letter to the GSCC portal.

Documents Required for GSCC Application

You must also keep the following documents handy when applying for the Guruji Student Credit Card Scheme:

Document | Format |

|---|---|

Colour photograph of the applicant and the co-applicant/co-borrower | JPEG/JPG file between 20 and 50 KB |

Signature of the student and co-borrower/guardian | JPEG/JPG file between 20 and 50 KB |

Aadhaar card | JPEG/JPG file between 50 and 400 KB |

PAN card (if applicable) | JPEG/JPG file between 50 and 400 KB |

Admission receipt of the student | JPEG/JPG file between 50 and 400 KB |

Address proof of co-applicant/co-borrower | JPEG/JPG file between 50 and 400 KB |

Prospectus/certificate including admission fee, examination fee, hostel charges etc., issued by the competent authority of the institution | JPEG/JPG file between 50 and 400 KB |

Check the links below to learn more about student credit card schemes across India!

Related Articles:

For any queries regarding the Jharkhand student credit card 2025, feel free to dial our toll-free number 1800-572-9877 or fill out CollegeDekho’s Common Application Form or log on to the CollegeDekho QnA Zone for admission-related queries.

Are you feeling lost and unsure about what career path to take after completing 12th standard?

Say goodbye to confusion and hello to a bright future!

FAQs

Yes, you can apply for the GSCC scheme in your final year of the course. A student can apply for the GSCC scheme at any time during their course, subject to the condition that no previous education loan has been availed by the student for the same course.

You may use the Guruji Student Credit Card Loan for the following:

- Tuition expenses

- Institutional expenses during the period of study

- Accommodation

- Mess/food provided in the institution

- Caution deposit/ building fund / refundable deposit/ examination/ library/ laboratory

- Books/computer/laptop/tablet etc., provided by the institute

- Rent/ license fees for living outside the hostel or living as a Paying Guest, and other expenses.

No, you do not need to send the hard copy of the GSCC registration form to the relevant authorities. However, you should keep a hard copy of the GSCC registration form for future reference.

The official website for Guruji Student Credit Card Yojana registration is gscc.jharkhand.gov.in. You may visit the website for registration and to keep track of your application.

Was this article helpful?

Similar Articles

Top 10 North Campus Colleges in Delhi University (DU): NIRF Ranking, Popular Courses, Admission Process

Top 10 South Campus Colleges in Delhi University (DU): Courses Offered & Cutoff Trends

Bhim Rao Ambedkar College CUET UG Cutoff 2025: Expected Cutoff based on Previous Trends

List of Documents Required for OJEE 2025 Counselling

Top CUET Universities in India - NIRF Ranking 2025

How to Score 90 Percent in Class 12? - Preparation Tips to Score 90% in 12th