In India, Chartered Accountants (CAs) are considered a prestigious job profile and their demand is increasing in the market every year. Individuals having an interest in tax and accounting should study CA. Those wondering how to become a CA have to enrol themselves in the CA course offered by ICAI (Institute of Chartered Accountants of India) and clear Foundation, Intermediate and Final exams. To become a CA, individuals must complete the 3-year articleship training. There are two ways to be admitted into the CA course, through the Foundation course or Direct Entry, the criteria for them are, however, different. A CA aspirant has to devote at least 4-5 years to the curriculum to become a certified CA. Although, the journey to becoming a CA is not so easy, however, with sheer dedication nothing is impossible.

After completing the CA course , the certified professionals are hired by public and private companies to set up their budget plans, financial reports, etc. CA is a professional degree given to accounting professionals in countries around the world. Those who want to become a Chartered Accountant in India, have to complete three levels of training that ICAI designs. Only after qualifying all three levels will the candidate be given the designation of a CA. The ICAI is a statutory body that is responsible for regulating and maintaining the profession of Chartered Accountancy in India. Individuals interested in becoming a CA need to gather information after completing Class 10. To get a better idea of how to become a CA, aspirants can read this article.

How to Become a CA Highlights

Individuals wondering how to become a CA in India should get quick insights about this profession. Check out the significant highlights of a CA in the table given below:

Particulars | Details |

|---|---|

Course Name | Chartered Accountancy Course or CA Course |

Conducting Body | The Institute of Chartered Accountants of India (ICAI) |

CA Course Duration | CPT Route: 4.5 - 5 years Direct Entry Route: 3 years |

Admission to the CA Course |

|

Age Limit | No age limit |

CA Eligibility Criteria | For Foundation Route To become eligible for the CA Foundation exam, a candidate must have completed four months of the required study period after registering as a CA with ICAI and have passed the class 12 exam.

The candidates who can take direct admission to the CA Intermediate level are :

|

CA Course Levels | 3 and a 3-year of articleship training |

CA Course Fees |

|

Job Sectors | Auditing, Finance, Taxation Advisory |

Average Salary | INR 8 LPA to 9 LPA |

CA Eligibility Criteria

If you are thinking about how to become a Chartered Accountant, you need to meet the eligibility requirements to appear for the CA exam. There are 2 ways to become a Chartered Accountant and the eligibility criteria are different for both the process. The different levels of becoming a CA are CA Foundation, CA Intermediate and CA Final. Read below to understand the eligibility criteria for each level of CA.

CA Foundation

Students willing to appear for the CA Foundation exam need to secure a minimum of 50% aggregate marks in their class 12 Commerce stream or at least 55% aggregate score in the Science stream. The candidates can only appear for the Foundation exam if they have registered with the Board of Studies and mandatorily studied for four months. However, CA aspirants can register for the CA Foundation exam after passing class 10th from a recognized board of education in India or an equivalent exam as recognized by the Central Government of India.

CA Intermediate

Candidates who want to know how to become a Chartered Accountant should understand the CA Foundation route and the Direct Entry route. In either of these two ways, an aspirant can sign up for the CA Intermediate level course. Find below the CA Intermediate eligibility requirements for both routes:

- Candidates can appear for the CA Intermediate level exam, only if they clear the CA Foundation exam with a minimum of 40% in each subject and an overall 50% minimum score.

- Aspirants who have studied Commerce must receive 55% overall marks in their graduation or post-graduation OR, Non-Commerce background graduates must get an overall score of 60% or above to directly apply for the CA Intermediate course level.

- Other than the aforementioned eligibility criteria, the students who have passed the ICWAI/ ICSI Intermediate level are also eligible to apply directly for the CA Intermediate level.

CA Final

The last stage of becoming a Chartered Accountant is the CA Final exam. To enrol in this stage, the students should have cleared both groups of the CA Intermediate exam with 40% marks in each subject and 50% overall marks at the Intermediate level. It is also mandatory for the students to complete the articleship training for at least 2 to 2.5 years during the CA Intermediate level.

Suppose you are wondering how to become a Chartered Accountant, in that case, you should know that ICAI has made some provisions in 25E, 25F and 28F of the CA regulations that allow candidates of class 10 to get admission through a provisional route.

Also Read: ICAI CA Foundation Course: Dates, Eligibility, Syllabus

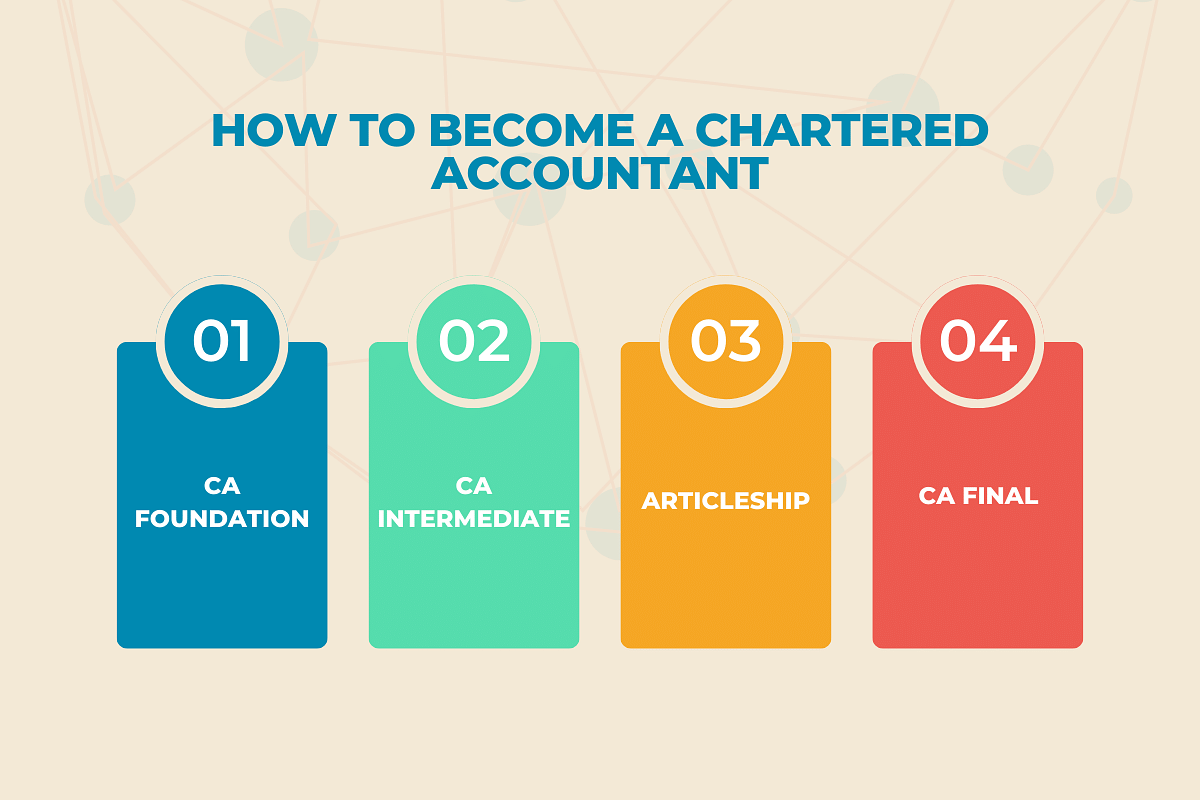

How to Become a CA in India?

There are only 2 routes to become a CA in India and aspirants have to choose any one route based on their eligibility requirements. Candidates have to follow different selection processes for joining different levels of the CA course. The below process highlights the crucial details of how to become a CA in India. The 2 routes are:

- Through Foundation course

- Through Direct Entry

The details on how to become a CA through two different routes have been discussed below in detail. Read here to learn more about the CA procedure.

Through Foundation Course

The candidates who have completed their Class 12th can follow the foundation course route which involves certain steps:

- CA Foundation

- CA Intermediate

- Articleship Training

- CA Final

CA Foundation

Candidates who have passed the class 12th exam can register for the CA Foundation level. Candidates, after completing registration with the ICAI Board of Studies (BoS) have to fulfil a minimum of 4-month period of study, which will make the applicants eligible to sit for the CA Foundation level exam. Before each session, participants are required to fill out the CA Foundation exam form to participate in the session. Enrollment in the Foundation course has a duration of validity that extends for three years. To pass the CA Foundation examination, the aspirants have to score at least 40% in each subject and an overall aggregate percentage of 50%. Candidates who fail to score the minimum marks required to pass the exam have to appear for the examination again in each of the four subjects on their next attempt.

Find out the subjects that need to be completed in the CA Foundation course.

Principles and Practice of Accounting | Business Laws and Business Correspondence and Recording |

|---|---|

Business Mathematics, Logical Reasoning and Statistics | Business Economics and Business and Commercial Knowledge |

The next step after passing the CA Foundation exam is the CA Intermediate level.

CA Intermediate

After registering for the CA Intermediate course, the candidate has to complete 8 months of study period. Thereafter, the applicant needs to fill out the CA Intermediate exam form. The CA Intermediate level has 2 groups, where each group consists of four different papers or subjects. It is up to the candidates to appear for just one group at a time or appear for both groups at the same time. The 8 subjects covered in the CA Intermediate level course are:

CA Intermediate Group 1 | CA Intermediate Group 2 |

|---|---|

Accounting | Advanced Accounting |

Corporate and Other Laws | Auditing and Assurance |

Cost and Management Accounting | Enterprise Information Systems & Strategic Management |

Taxation | Financial Management & Economics for Finance |

Students have to individually score 40% or more in each subject or 50% or more in the total score. In addition, a provision of exemption is available for students of CA Intermediate who achieve a score of at least 60% or higher in a particular subject. In situations where a candidate who attempted group 1 exams and passed two subjects with scores higher than 60% but could not clear the remaining 2 papers can apply for exemption in the subjects in which he scored 60 or more marks.

Candidates who wish to become a CA in India have to complete their Integrated Course on Information Technology and Soft Skills (ICITSS) during their CA Intermediate level before moving forward with the articleship training.

Articleship Training

Aspirants enrolled in the Chartered Accountancy course must complete three years of practical training. After completing one or both groups of CA Intermediate, a candidate can enrol for an articleship. Candidates must finish the Advanced Integrated Course on Information Technology and Soft Skills (AICITSS) in the final two years of their training before taking the CA Final exams. Although the training lasts three years, applicants can sit for the CA Final exams during the last six months of their training.

CA Final

Only candidates who have passed the CA Intermediate groups can appear for the CA Final exam. Those individuals who have successfully finished both ICITSS and AICITSS and have reached the last stage of the articleship training are qualified to fill out the CA Final exam form and take the exam. To pass the CA Final exam, a candidate must score a minimum of 40% in each subject and an average of 50% or higher. During the Final level, candidates can also benefit from the exemption rule, where a candidate who has gone on to score above 60% in a particular paper can apply for exam exemption in that subject. This way, they do not have to reappear for that paper and thus reduce the number of subjects to clear. The exemption will be valid for the next three terms of exams.

The CA Final paper has 2 groups, each group having 4 papers adding up to 8 subjects in total. The candidates will get the option to appear for one group at once in the Final level. Find below the CA Final subjects for both groups.

CA Final Group 1 | CA Final Group 2 |

|---|---|

Financial Reporting | Advanced Management Accounting |

Strategic Financial Management | Information Systems Control and Audit |

Advanced Auditing and Professional Ethics | Direct Tax Laws |

Corporate and Allied Laws | Indirect Tax Laws |

Apply for ICAI Membership

Applicants who have finished their articleship training and cleared both the CA Final groups are eligible to apply for membership in the Institute of Chartered Accountants of India (ICAI).

Through Direct Entry

Please follow the details below on how to become a Chartered Accountant in India through direct entry with provisions for exemption from the CA Foundation course in cases of specific qualifications. Below are the applicant categories who are qualified for the CA Intermediate course through direct entry:

- Students from a commerce background need to score a minimum of 55% marks in their graduation or post-graduation degree.

- Candidates who are from other streams should have scored 60% aggregate marks to apply.

- CA aspirants need to achieve passing marks or more in the CS Executive exam, administered by the Institute of Company Secretaries of India (ICSI).

- Those applicants who choose to become a CA after completing a bachelor's degree or any other similar qualification and are enrolled into the CA Intermediate level through direct entry must complete a practical training program of 9 months after completing their registration for the CA Intermediate level.

- After the training period is over, eligible candidates can submit their applications for the CA Intermediate exam and take part in the upcoming session of exams.

After submission of the applications, the candidates have to follow a similar process from the CA Intermediate level, which they would have done in case they had joined the CA course via the Foundation Route.

They have to clear one or both sections of the CA Intermediate exams and sign up for Articleship training. They have to pass both the CA Intermediate level groups, complete 3 years of Articleship training, and then register for the Final level of CA. The applicants must then achieve passing marks or more in both sections of the CA Final level and apply for membership in the ICAI CA.

Also Read: ACCA vs CA- Which is Better for Your Career?

Skills Required to Become a CA

Aspirants who want to become a CA in India need to have certain skill sets that will help them in their profession. Generally, CAs work in a group, in an accounting firm, a business, etc. so they should have some important skills. Find below the required CA skills:

Communication Skills | Time Management |

|---|---|

Analytical Skills | Problem-Solving Skills |

Teamwork and Collaboration | Organisational Skills |

Commercial Awareness | Ethics |

Advantages of a CA

The demand for CAs in the market is huge, so candidates will get the opportunity to work in the business and finance sectors. The average salary that a CA can draw is quite good in India. Candidates do not need prior work experience to enrol in the CA course. But, if you want to become a Chartered Accountant, you need to complete an articleship and get training. That is necessary to obtain a license to work as a CA professionally.

- CA as a career is very popular in India and almost all businesses and organisations need a CA which means there are opportunities and stable income.

- A career as a CA is flourishing due to its global recognition as a highly regarded position. After passing the CA exam, plenty of well-paying jobs are available in top business and finance firms.

- A CA degree is a full-fledged professional degree offered by ICAI which is a certified institute. There is no requirement to attend classes regularly, allowing students to study multiple CA subjects at their own pace.

CA Job Profile and Salary

The CAs have a huge demand in firms, finance companies, legal firms, stockbroking firms, banks, etc. Now that you know how to become a CA in India, you should focus on the job opportunities that CAs can get. However, the salary options are not bright during CA articleship but candidates can expect a good salary after completing the course.

The starting salary of a Chartered Accountant will be around INR 6 LPA to 9 LPA. With experience, the salary of a CA will increase and can expect to earn INR 25 LPA to 5 LPA. However, the salary of a CA depends on the city and company he/ she gets employed in. Here are the top job profiles of a CA along with the average salaries that they can expect:

Job Profile | Average Salary |

|---|---|

Chartered Accountant | INR 8 LPA - 17 LPA |

Annual Salary of a CA Topper (Fresher) | INR 25 LPA - INR 30 LPA |

Financial Analyst | INR 7 LPA - 12 LPA |

Tax Manager | INR 7 LPA - 12 LPA |

Chief Financial Officer (CFO) | INR 10 LPA - 15 LPA |

Consultant | INR 8 LPA - 14 LPA |

INR 10 LPA - 16 LPA | |

Audit Manager | INR 8 LPA - 15 LPA |

Finance Manager | INR 10 LPA - 18 LPA |

Top Recruiters of CA

The CAs can work in various industries such as banking, finance, insurance, manufacturing, hospitality, healthcare, etc. Listed below are some of the top domestic and international recruiters who hire CAs:

Top Domestic Recruiters | Top International Recruiters |

|---|---|

Tata Consultancy Services (TCS) | Amazon |

Wipro | PwC |

HCL Technologies | Deloitte |

Infosys | McKinsey & Company |

State Bank of India | Goldman Sachs |

JS Sundaram & Co. | EY |

Luthra & Luthra | JP Morgan Chase & Co. |

Federal Bank | KPMG |

Axis Bank | Morgan Stanley |

Kotak Mahindra Bank | Citi |

ICICI Bank | Credit Suisse |

Standard Chartered Bank | Deutsche Bank |

SS Kothari Mehta & Co | Kuwait Resources House |

RBL Bank | Edelweiss |

Luthra & Luthra | Rak Investment Authority |

Related Articles :

| Commerce Education in India | CA VS B.Com: Which is a Better Option After Class 12? |

|---|

Stay tuned to CollegeDekho for more updates and information on colleges, courses, and admissions.

Are you feeling lost and unsure about what career path to take after completing 12th standard?

Say goodbye to confusion and hello to a bright future!

FAQs

If you want to become a CA in India, you need to get admitted either through a CA Foundation course or Direct Entry. Complete all the levels in the CA Foundation course such as the CA Foundation course, CA Intermediate course, Articleship Training, and CA Final course and apply for ICAI membership. Those applying through Direct Entry have to follow the specific qualifications and after completion, they have to follow a similar process as the CA Intermediate level.

CA Final is the last stage of becoming a Chartered Accountant and to enrol in this last stage, the students should have cleared both groups of the CA Intermediate exam with 40% marks in each subject and 50% overall marks at the Intermediate level. It is also mandatory for the students to complete the articleship training for at least 2 to 2.5 years during the CA Intermediate level.

The CA Final paper has 2 groups, each group having 4 papers adding up to 8 subjects in total. The candidates will get the option to appear for one group at once in the Final level. The subjects included are Financial Reporting, Strategic Financial Management, Advanced Auditing and Professional Ethics, Corporate and Allied Laws, Advanced Management Accounting, Information Systems Control and Audit, Direct Tax Laws and Indirect Tax Laws.

Students who want to appear for the CA Foundation exam should have secured a minimum of 50% aggregate marks in their class 12 Commerce stream or at least 55% aggregate grade in the Science stream. The candidates can only appear for the Foundation exam if they have registered with the Board of Studies and mandatorily studied for four months.

Commerce candidates who want to join through the CA Direct Entry route should have secured at least 55% and those from non-commerce backgrounds need to have scored 60%. Applicants who have achieved passing marks or more in the CS Executive exam, administered by the Institute of Company Secretaries of India (ICSI) or have received a passing grade in the CMA Intermediate exam.

Candidates who want to become a CA need to have some important skills such as Communication Skills, Time Management, Analytical Skills, Problem-Solving Skills, Teamwork and Collaboration, Organisational Skills, Commercial Awareness and Work Ethics.

There are 2 ways to get admitted to the CA course, through the Foundation course or through Direct Entry. The Foundation course includes a few steps such as CA Foundation, CA Intermediate, Articleship Training, CA Final and applying for ICAI Membership. In Direct Entry, candidates who have completed their graduation or postgraduate degree can apply directly and then follow the same route as the CA Intermediate level.

To become a CA in India, candidates have to complete three levels of training that are designed by ICAI (Institute of Chartered Accountants of India). It is only after qualifying all three levels that the candidate will be given the designation of a CA. The ICAI is a statutory body that is responsible for regulating and maintaining the profession of Chartered Accountancy in India.

The top recruiters of the CA candidates are Tata Consultancy Services (TCS), Amazon, Wipro, PwC, HCL Technologies, Deloitte, Infosys, McKinsey & Company, State Bank of India, Goldman Sachs, JS Sundaram & Co., EY, JP Morgan Chase & Co., Federal Bank, KPMG, Axis Bank, Morgan Stanley, etc.

Chartered Accountants are professionals who are hired by private and public organisations to deal with the account details of an organisation. A CA can work for businesses, organisations, financial institutions and the government.

Was this article helpful?

Similar Articles

Is 200 marks good in CA Foundation?

What is the passing criteria for CA Foundation exam?

How CA Foundation helps in CA Intermediate exam?

Is CA Foundation compulsory for CA aspirants?

Who is eligible for direct entry into the CA Intermediate course?

How many attempts are allowed for CA Foundation?