Last Updated On 25 Aug, 2020

A Claims Manager is a person who is responsible for ensuring that the insurance claims are handled correctly. He also ensures that the payment which was made is correct in accordance with the company’s policy. A Claims Manager also reviews the work of adjusters at regular intervals and makes final adjustments before finalising the claim amount. The main work of the Claims Manager is to manage the daily operations of claim adjusting and supervising the work of adjusters. Candidates who are looking for a career as a Claims Manager should have excellent analytical skills so that they can go through all the important details during the claim payment process.

Check some major responsibilities of a Claims Manager listed below.

Designing and implementing various procedures and policies for claims

Preparing report comprising of reasons of taking the claim and payment completion

Scheduling all external and internal audits on all claims issues

Providing training to the juniors and new team members

Performing regular surveillance of all claim issues and analysing them

Evaluating all business units associate claims

Candidates aiming to become a Claims Manager need to fulfil some of the requirements decided by the company. The eligibility criteria to become a Claims Manager is given below.

Education Required |

|

Work Experience |

|

Skills | Some of the skills required for a Claims Manager are:

|

Check the table provided below to know some of the courses, you can pursue in order to become a Claims Manager. Some of the well known Business Management colleges are also provided below. You can apply to these colleges by filling our Common Application Form.

Course | Total Fee (Approx) | Top Colleges for Business Management |

INR 27,000 to INR 8.00 lakh | ||

INR 45,000 to INR 3.00 lakh | ||

INR 15,000 to INR 25.00 lakh | ||

INR 1 lakh to INR 6 lakh |

There are many job profiles available for a Claims Manager. Some of the major job profiles available for Claims Manager are listed below.

Claims Adjuster

Claims Director

If you want to know more about employment opportunities and job profiles available for Claims Manager, you can ask your questions on the Collegedekho QnA zone.

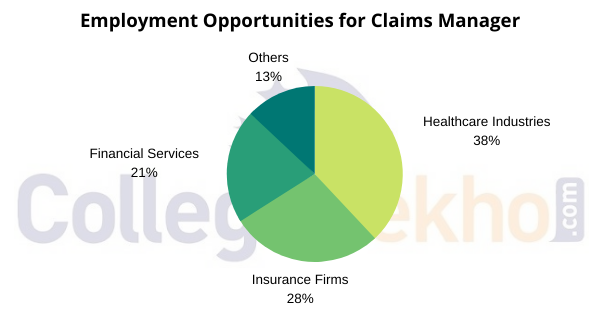

Job roles of Claims Manager will vary from industry to industry. He can work in many industries such as healthcare, insurance, financial services, business service and hospitality. You can check the graph provided below to have a better idea about the employment opportunities available for a Claims Manager.

Some of the major recruiting companies for a Claims Manager are listed below.

Aditya Birla Sun Life Insurance Co. Ltd.

TATA AIA Life Insurance Co. Ltd.

PNB MetLife India Insurance Co. Ltd.

Shriram Life Insurance Co. Ltd.

SBI Life Insurance Co. Ltd.

Kotak Mahindra Life Insurance Co. Ltd.

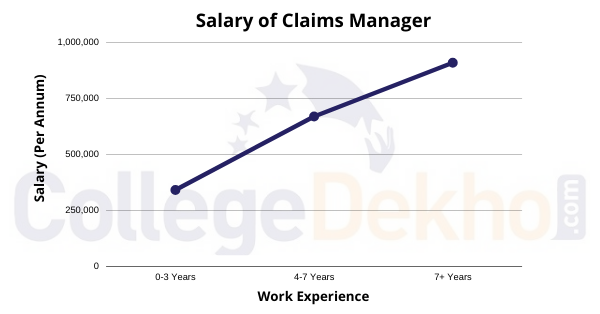

A fresher in the industry can get an average salary of INR 4 lakh per annum. Besides this, those who have experience of 2-3 years can earn up to INR 6 lakh per annum.

Profile | Starting Salary per annum (in INR) | Mid Level Salary per annum (in INR) | Senior Level Salary per annum (INR) |

Claims Manager | 3,42,000 | 6,70,000 | 9,10,000 |

A Claims Manager should be well updated with the company's policy. Besides this, he should have good presentation skills. There are many books that can help the Claims Manager to learn new strategies and knowledge about managing the claim process. Some of them are provided below.

Insurance Claim Secrets Revealed by Russell D. Longcore

P&C Insurance Claim Management by Michael Murdock

Resolving Insurance Claim Disputes Before Trial by Judith F. Goodman and Timothy H. Penn

The Insurance Claim Consultant by Daniel D. Young

Win the Claim Game by Joel Zimelstern

This profile offers you a flexible job schedule

A career as a Claims Manager is perfect for the candidates who like a desk job

Some of the companies also offer a bonus over the fixed salary

This profile will help you improve your analytical skills

Work experience of 3+ years is required

You will be handling different kinds of problems

You will have to manage the work of Adjusters

Take our test and find out if it suits your strengths.

You will handle different kinds of situations and the workload might be a bit too much while handling multiple claims.

Some of the recommended books for Claims Manager are Resolving Insurance Claim Disputes Before Trial by Judith F. Goodman and Timothy H. Penn and The Insurance Claim Consultant by Daniel D. Young.

Some of the major recruiters for Claims Manager are PNB MetLife India Insurance Co. Ltd., Shriram Life Insurance Co. Ltd. and SBI Life Insurance Co. Ltd.

Some of the skills required for a Claims Manager are Analytical skills, Problem-solving skills, Communication skills and Leadership skills.

You must have completed a bachelor’s degree in business management in order to become a Claims Manager.

A Claims Manager is responsible for ensuring that the insurance claims are handled correctly. Besides this, he also prepares a report comprising payment completion and reasons for the claim.

The average salary of a Claims Manager will vary depending on his experience and skills. He can earn up to 9 lakh per annum.

Claims Manager can apply to the healthcare industry, Insurance firm, Education Industry or Finance services.

Some of the other job profiles available for a Claims Manager are Wealth Manager, Insurance Agent, Operations Manager and Customer Service Manager

Some of the major responsibilities of a Claims Manager include supervising the work of Adjusters and Scheduling all external and internal audits on all claims issues.