Last Updated On 14 Aug, 2020

Accounts Receivable Manager is a mid-level job position in the accounting department of an organisation. It involves managing daily accounting activities and ensuring that all activities such as invoicing, transactions, taxation etc. are maintained accurately and kept up to date. An Accounts Receivable Manager is also in charge of the payments received by a company. He/she has to design and oversee the process of payment collection and ensure that the collections are being done on time.

Accounts Receivable Managers must keep an eye on the cash inflow of a company and make sure that its proper record is being maintained. They are also tasked with managing the team members of the accounting department and will be required to delegate tasks, track progress and monitor day-to-day activities. They must also be able to negotiate payments from customers and be able to come up with effective solutions to accounting problems of a company.

Check the table below for the requirements to become an Accounts Receivable Manager.

Education |

|

Certification | CPA certification may be required. |

Work Experience | 3 - 5 years of work experience in a relevant position is required. |

Skills |

|

The following table contains some of the best courses to become an Accounts Receivable Manager.

Course | Average Course Fee | MBA Finance Colleges |

Rs. 50,000 - Rs. 1,50,000 | ||

Rs. 1,50,000 - Rs. 2,00,000 | ||

Rs. 60,000 - Rs. 1,00,000 | ||

| Rs. 2,50,000 - Rs. 3,00,000 |

For an easy and convenient way to apply to popular commerce and management colleges in India from a single platform, fill the Common Application Form (CAF). If you have any queries regarding admission, please contact our helpline 18005729877.

Accounts Receivable Managers can be hired for different departments of large organisations. Accounts Receivable professionals can also be promoted at multiple levels of managerial posts. The types of job roles similar to that of an Accounts Receivable Manager can be found below.

Manager - Commercial Accounts Receivable

Sr. Accounts Receivable Manager

Accounts Receivable Supervisor

Asst. General Manager - Accounts Receivable

Given below are the key responsibilities for an Accounts Receivable Manager job role.

Ensure that the payment collections are being done on time.

Oversee the invoicing process.

Maintaining company accounts, preparing account statements and expense reports.

Reviewing outstanding payments and contacting clients.

Filing taxes and returns.

Monitoring and approval of collection reports etc.

Accounts Receivable Managers are a necessary requirement in the accounting departments of many small-scale and large-scale companies. It is a fairly common job requirement in private organisations and students can find a significant number of job vacancies in the market for Accounts Receivable Managers. The scope for Accounts Receivable Managers is also good. Their experience and skills can be employed in a variety of other accounting and financial management roles.

The need for an Accounts Receivable Manager is primarily at companies that offer their customers a service or product before asking for the payment. Once the service has been provided, the company has an outstanding invoice and a payment or accounts receivable is due to the company. There are many companies where this is a common practice, one example being electricity companies, gas companies etc.

Therefore, these and other similar types of companies hire Accounts Receivable Managers to keep a track of how much service or product they have provided on credit. The Accounts Receivable department ensures that the payments due to the company are made on time and sets up the process for the same. Accounts Receivable Managers can, therefore, look for jobs in companies that provide their services on a post-paid basis.

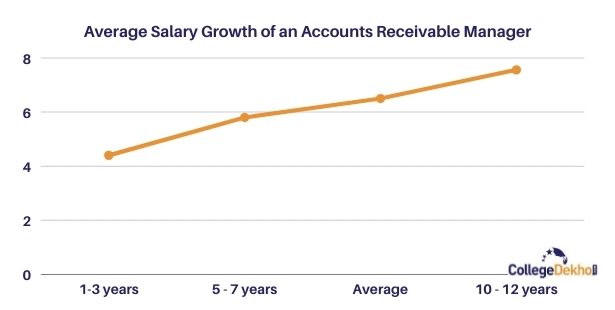

The following table and graph given below describe the average salary details of an Accounts Receivable Manager in India.

| Job Role | Average Salary | Entry-Level Salary | Mid-Career Salary | Senior-Level Salary |

| Accounts Receivable Manager | Rs. 6.50 lacs | Rs. 4.40 lacs | Rs. 5.80 lacs | Rs. 7.50lacs |

Given below are some of the best books for Accounts Receivable Managers.

Accounts Receivable Management by John G. Salek

Essentials of Credit, Collections, and Accounts Receivable by Mary S. Schaeffer

Managing Accounts Receivable: How 54 Sales Professionals Collect Past Due Accounts by Bob Oros

Credit & Collection Guidebook by Steven Bragg

Cash Before You Crash: A complete Manual on Credit and Accounts Receivable Operations in Digital Age by Ajoy Guha

It is a good job for the people who are good with numbers and finances.

It prepares you for a career in Finance Management and you can look for better career opportunities on the basis of experience gained as an Accounts Receivable Manager.

It is an office job and good for professionals who wish to follow a more stable and settled-down lifestyle.

You have to work with confidential information and hence strict company policies have to be followed by professionals.

The job requires frequent interaction with clients and it is not easy to ensure collections.

The salary growth can be a bit slow.

Take our test and find out if it suits your strengths.

Fresher candidates are not hired for Accounts Receivable Manager roles. They have to go through clerical jobs and are only considered for the managerial post after around 5 years of work experience.

An Accounts Receivable Manager should have excellent communication skill, must be attentive towards details, thorough with processes, able to provide quick solutions and must be a good negotiator.

The average salary for an Accounts Receivable Manager is around Rs. 6.5 to 7 LPA.

Yes, you will find that all of the courses such as BCom, BBA, MBA etc., which are recommended to Accounts Receivable Managers, are offered through the distance education mode. It is a valid route to take for this job role.

The best college for you will depend on your qualification level as well as the course you wish to pursue. For eg. the following BCom colleges will help you prepare for an Account Receivable Manager job role -- GITAM University, Loyola College, KL University, Sanskriti University, Biyani Group of Colleges etc.

Two of the best undergraduate courses you can consider are BCom and BBA. At the postgraduate level, MCom and MBA, particularly in the field of Finance, would be your best choices.

Yes, CA is one of the best courses for Accounts Receivable Managers. In fact, many companies only hire CAs for the Account Receivable Manager post.

Yes, a bachelor's degree is the minimum qualification required to become an Accounts Receivable Manager. However, many companies also require candidates to have a postgraduate qualification to be eligible for this role.

There are many companies that offer their services or products before they ask for payment from the client. Such companies require and Accounts Receivable Manager to ensure that they get all the collections due to them.

An Accounts Receivable Manager is a person who oversees and supervises the team or department responsible for ensuring collections for a company. It is a job role in the accounting department of a company.