- AP Intermediate Accountancy Syllabus 2024-25 Download PDF

- AP Intermediate Accountancy Syllabus 2024-25 in English Medium

- AP Intermediate Accountancy Syllabus 2024-25 in Telugu Medium

- Steps to Download AP Intermediate Accountancy Syllabus 2024-25?

- AP Intermediate Accountancy Important Books

- AP Intermediate Accountancy Preparation Tips

- Faqs

Never Miss an Exam Update

AP Intermediate Accountancy Syllabus 2024-25:

The Andhra Pradesh Board of Intermediate Education (BIEAP) will make the AP inter 2nd year Accountancy syllabus 2024-25 available in both Telugu and English mediums on its official website at bie.ap.gov.in/. Students who are preparing for the AP inter 2nd year exam in the upcoming academic year 2024-25 can check and download the latest BIEAP 12th accountancy syllabus 2025 from this page as well. The AP Inter 2nd year Accountancy exam will be conducted for 3 hours. As per the

AP Intermediate exam pattern 2024

, the class 12th Accountancy exam will be 100, out of which 60 marks will be allotted for theory and the remaining 40 marks for practical.

AP Intermediate Accountancy syllabus 2024-25 includes a total of 10 chapters, namely, Bills of Exchange, Depreciation, Consignment, Not-For-Profit Organization, Partnership Accounts, Admission of a Partner, Retirement, Company Accounts, and Accounts from Incomplete Records. The AP inter 2nd year Accountancy paper will contain 18 questions in total and will be divided into two sections, Sections A and B. In Section A, students will have to answer 10 questions carrying 2 marks each. While in Section B, out of 8 questions, they will need to answer any 5 which will carry 6 marks each. Students are required to get a minimum of 35 marks in the BIEAP 12th accountancy exam to pass the subject. Students must complete the 12th Accountancy syllabus beforehand to solve the AP Intermediate previous year question papers . This article provides the latest and updated AP intermediate Accountancy syllabus 2024-25.

AP Intermediate Accountancy Syllabus 2024-25 Download PDF

Students can download the syllabus PDF from the link added below.AP Intermediate Accountancy Syllabus 2024-25 in English Medium

The AP inter 2nd year theory exam 2024 will be conducted between March and April 2024 in the morning shift from 9 am to 12 noon. The AP intermediate practical exams will take place in February 2024 in two sessions. The AP inter 2nd year Accountancy syllabus 2024-25 in English medium is provided below:

S.No. | Chapter Name | Topic |

|---|---|---|

1 | Bills of Exchange | 1.1 Meaning and Definition 1.2 Features of a Bill of Exchange 1.3 Parties to a Bill of Exchange 1.4 Advantages of a Bill of Exchange 1.5 Types of Bills of Exchange

1.6 Difference between a Bill and a Promissory note 1.7 Difference between a Bill and a Cheque 1.8 Important Terminology 1.9 Accounting Treatment for Bills of Exchange

|

2 | Depreciation | 2.1 Meaning and Definition 2.2 Need for depreciation 2.3 Causes of Depreciation 2.4 Accounting Treatment, Purchase of Asset, Purchase of Asset, Use of Asset, Sale of Asset 2.5 Methods of providing depreciation 2.6 Straight Line Method 2.7 Reducing Balance Method

|

3 | Consignment | 3.1 Introduction 3.2 Characteristics/Features of Consignment 3.3 Difference between consignment and sale

3.5 Commission

3.6 Accounting Treatment in the Books of Consigner

3.7 Accounting Treatment in the books of Consignee

3.8 Valuation of Unsold Stock 3.9 Loss of stock-Types

|

4 | Not-For-Profit Organization | 4.1 Introduction 4.2 Characteristics 4.3 Capital and Revenue Transactions 4.4 Distinction Between Profitable and Not-for-Profit Organizations 4.5 Formation of Not-For-Profit Organizations 4.6 Accounting Records to be maintained in Not-For-Profit Organizations

4.7 Preparation of Receipts and Payments Account

4.8 Preparation of Income and Expenditure Account, Features of Income and Expenditure Account, Distinction between Receipts and Payments Accounts and Income and Expenditure Account, Conversion of Receipts and Payments Accounts and Income and Expenditure Account 4.9 Treatment of Important Items 4.10 Balance Sheet |

5 | Partnership Accounts | 5.1 Introduction 5.2 Meaning and Definition 5.3 Features of Partnership Firm 5.4 Partnership Deed

5.5 Distribution of Profit/Loss among partners

5.6 Maintenance of Capital Accounts of Partners 5.7 Interest on Partner’s Loan 5.8 Interest on Capital 5.9 Interest on Drawings |

6 | Admission of a Partner | 6.1 Introduction 6.2 New Profit Sharing Ratio

6.3 Revaluation of Assets and Liabilities 6.4 Adjustments of Reserves and Accumulated Profit or Losses 6.5 Goodwill

|

7 | Retirement/Death of a Partner | 7.1 Introduction 7.2 New Profit Sharing Ratio

7.3 Revaluation of Assets and Liabilities 7.4 Adjustment of Accumulated Profits and Losses 7.5 Treatment of Goodwill 7.6 Adjustment of Capitals 7.7 Disposal of Amount Due to Retiring Partner 7.8 Share of Profits/Losses up to date of deceased Partner |

8 | Company Accounts | 8.1 Introduction 8.2 Categories of Share Capital

8.2.2 Types of shares 8.3 Issues of Shares

|

9 | Computerised Accounting System | 9.1 Introduction 9.2 Computers in Accounting 9.3 Process of Computerised Accounting 9.4 Driving Forces for Computerised Accounting 9.5 Comparison of Manual and Computerized System 9.6 Advantages of Computerised Accounting System 9.7 Limitations of Computerised Accounting System 9.8 Sourcing of Accounting Software 9.9 Accounting Packages |

10 | Accounts from Incomplete Records | 10.1 Introduction 10.2 Meaning and Definition 10.3 Features of Accounts from Incomplete Records 10.4 Limitations of Accounts from Incomplete Records 10.5 Differences Between Single Entry System and Double Entry System 10.6 Preparing Statement of Affairs 10.7 Difference of Profit of Loss of Business 10.8 Ascertainment of Profit or Loss of Business 10.9 Application of Single Entry System to Partnership Firms |

Also check: AP Intermediate Grading System 2024

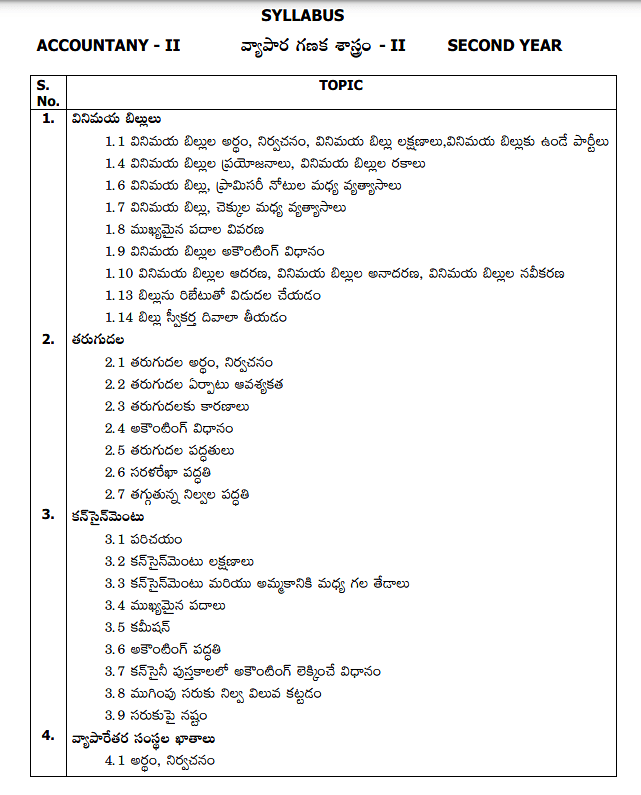

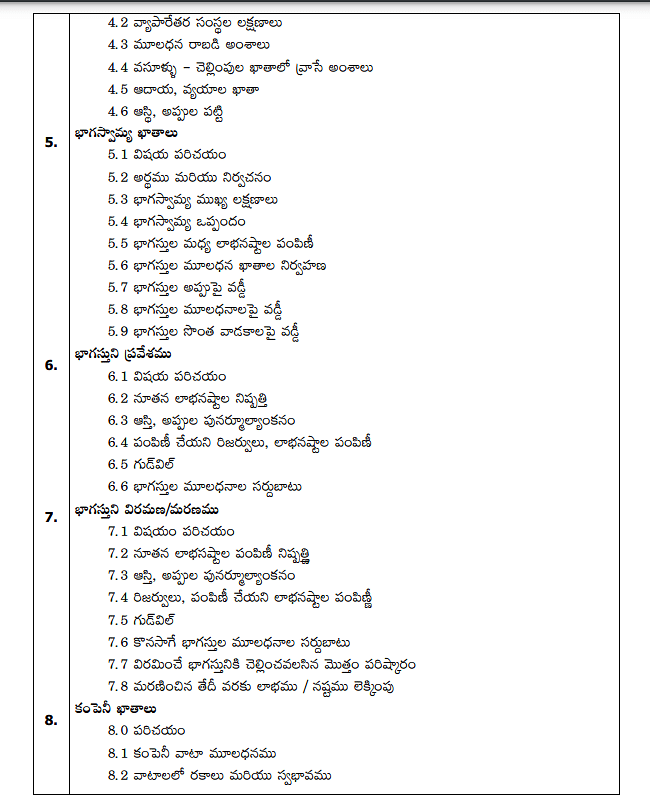

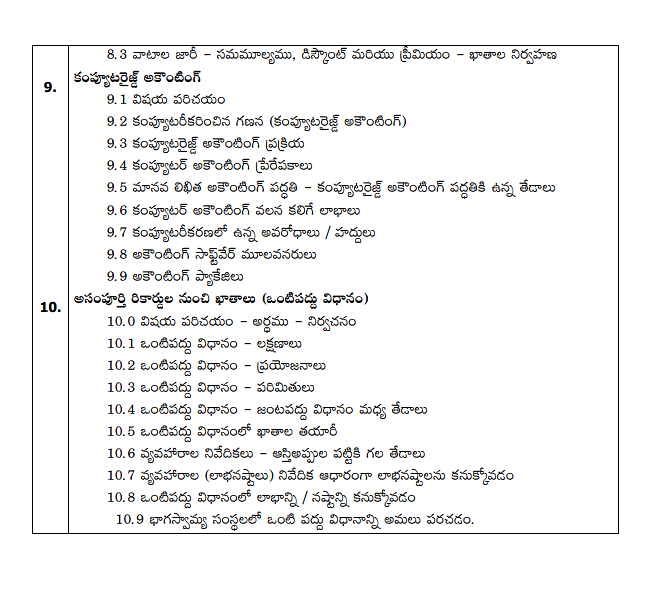

AP Intermediate Accountancy Syllabus 2024-25 in Telugu Medium

Students can go through the screenshots of AP intermediate accountancy syllabus 2024-25 given below:

Steps to Download AP Intermediate Accountancy Syllabus 2024-25?

The steps to download the AP inter 2nd year Accountancy syllabus 2024-25 from the official website of BIEAP are mentioned below:

- Step 1: Students need to visit the official website of the Andhra Pradesh board - bie.ap.gov.in/.

- Step 2: On the homepage, scroll down to the option “Syllabus and Resources” and click on it.

- Step 3: Then click on the link “Syllabus and Question Bank(Practical).

- Step 4: A new window will open on your screen. Thereafter you need to click on “All Arts Groups II Year”.

- Step 5: A pdf will open where you have to scroll down to the AP inter 2nd year Accountancy syllabus 2024-25.

- Step 6: Download the pdf and keep it for future reference.

AP Intermediate Accountancy Important Books

The Andhra Pradesh Board prescribes the AP Intermediate Accountancy books for the students to follow. Students are advised to refer to the AP Intermediate Accountancy books listed below for the exam preparation:

- Textbook for Intermediate Second Year - ACCOUNTANCY [ ENGLISH MEDIUM ] by Dr.P.Venkateswar Rao

- Intermediate Second Year Accountancy Text Book by Dr.P.Venkateswar Rao

- Textbook for Intermediate Second Year - ACCOUNTANCY [ TELUGU MEDIUM ]

AP Intermediate Accountancy Preparation Tips

Below are some of the essential tips for the class 12th commerce students to score high marks in the upcoming AP Inter 2nd year exam 2025:- Start your exam preparation by understanding the blueprint, and syllabus of the AP Intermediate Accountancy exam. Familiarise yourself with the marks allotted for all the chapters and topics. Identify the highest weightage carrying chapters and prepare accordingly.

- Accountancy can be mastered based on the foundation of the basic concepts. Concepts like financial statements, and accounting equations which form the core of the subject must be understood very well.

- Follow the AP Intermediate Accountancy textbooks that are recommended by the board. These are the primary source of the preparation. Read each chapter thoroughly, understand all the concepts and solve the examples provided.

- Practice regularly: AP intermediate Accountancy is a subject to be practised, and not merely read. Try to solve as much variety of problems as possible from each chapter. Solve different types of questions, also practice numerical questions rigorously.

- While preparing for the exam, try to use integrating flowcharts and diagrams which will significantly enhance the comprehnsion of the complex chapters.

- Practice the AP Intermediate Accountancy model papers and previous year question papers to understand the exam paper pattern, difficulty level and types of the questions asked.

FAQs

Yes, the AP inter 2nd year Accountancy syllabus 2024-25 is available in both English and Telugu medium.

The BIEAP 12th time table 2024 will be released in November 2024 tentatively. It can be anticipated that the AP inter 2nd year Accountancy exam 2025 will be held in March - April 2024.

The maximum marks in the AP inter 2nd year exam syllabus 2024-25 are 100. Out of these, 60 marks are for the theory paper and the remaining 40 marks will be for the practical exam.

You need to go to the official website of BIEAP to access the inter 2nd year Accountancy syllabus 2024-25 PDF. You can also download the BIEAP 12th syllabus 2024-25 from this page.

There are a total of 10 chapters in the AP inter 2nd year Accountancy syllabus 2024-25.

Was this article helpful?